Search

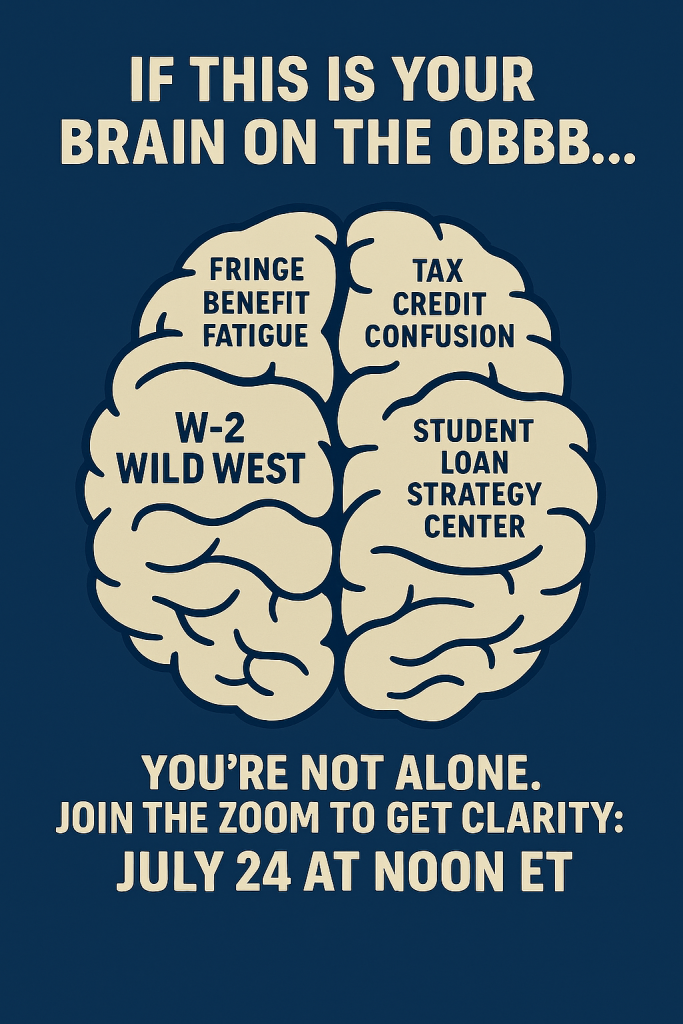

LIVE ZOOM PANEL: How the One Big Beautiful Bill Will Impact Your Workforce (July 24 at Noon ET)

Where have I been? I took a short break from July 4 through July 14 to spend some time offline on vacation with my family. Thanks for your patience—and I promise this one was worth the wait.

The One Big Beautiful Bill (OBBB) became law on July 4—and with it, major new tax and reporting obligations for employers. From payroll compliance to fringe benefit design, much of what’s in this law affects HR, legal, and finance teams directly.

To help employers get ahead of the coming changes, we’re hosting a live Zoom panel discussion (with time for audience Q&A) featuring three top minds in tax and benefits law.

🗓️ Thursday, July 24, 2025 at Noon ET

📍 Zoom: Register here

Continue reading

The Employer Handbook Blog

The Employer Handbook Blog

Paying employees a flat weekly salary doesn’t make them exempt from overtime. One employer just learned that lesson the expensive way—after misclassifying dozens of workers.

Paying employees a flat weekly salary doesn’t make them exempt from overtime. One employer just learned that lesson the expensive way—after misclassifying dozens of workers.