Search

Part Three: You Can’t Contract Away Work Time – and Overtime Rules for Commissioned Employees

On January 5, 2026, the U.S. Department of Labor’s Wage and Hour Division issued six opinion letters addressing a range of FMLA and FLSA issues. This post – part three of a three-part series – covers the final two letters, both under the FLSA, and both aimed at assumptions employers sometimes make about flexibility.

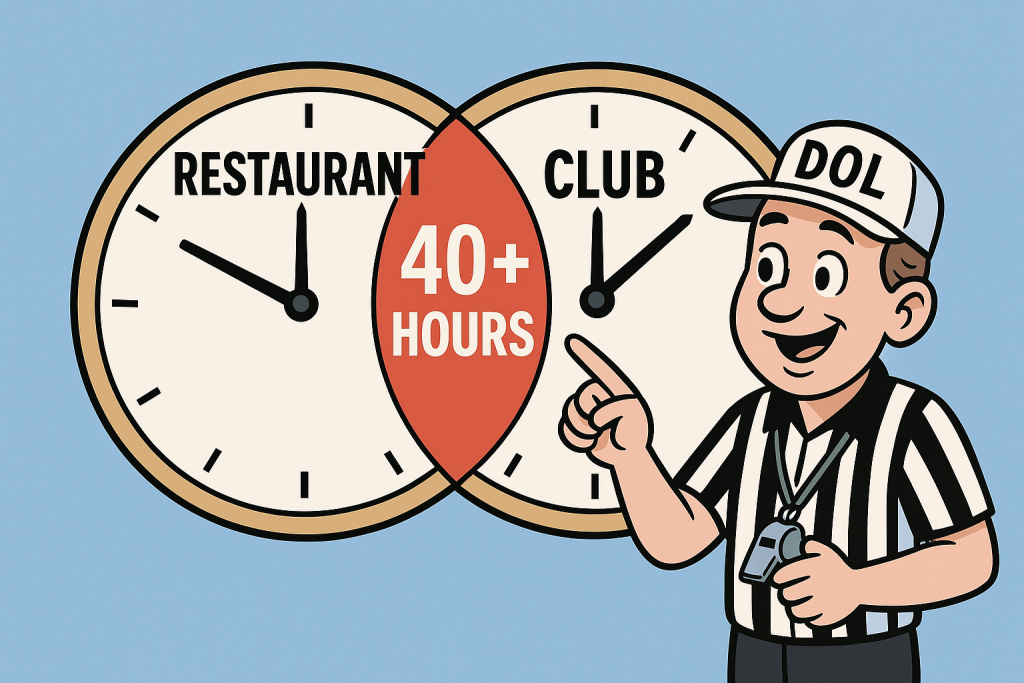

One letter addresses whether mandatory pre-shift “roll-call” time can be excluded from overtime calculations based on a collective bargaining agreement. The other addresses how to apply the commissioned-employee overtime exemption when state minimum wage exceeds the federal minimum wage – and what actually counts as commissions. Continue reading

The Employer Handbook Blog

The Employer Handbook Blog

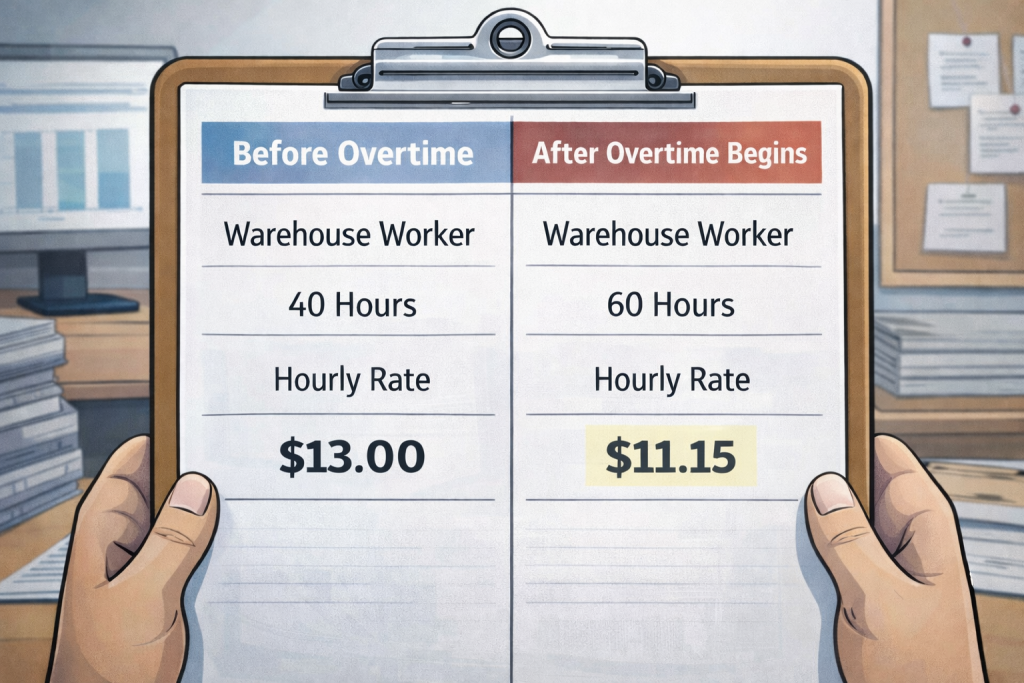

Paying employees a flat weekly salary doesn’t make them exempt from overtime. One employer just learned that lesson the expensive way—after misclassifying dozens of workers.

Paying employees a flat weekly salary doesn’t make them exempt from overtime. One employer just learned that lesson the expensive way—after misclassifying dozens of workers.