Search

Two Entities, One Employer: The DOL’s Latest Joint Employer Warning

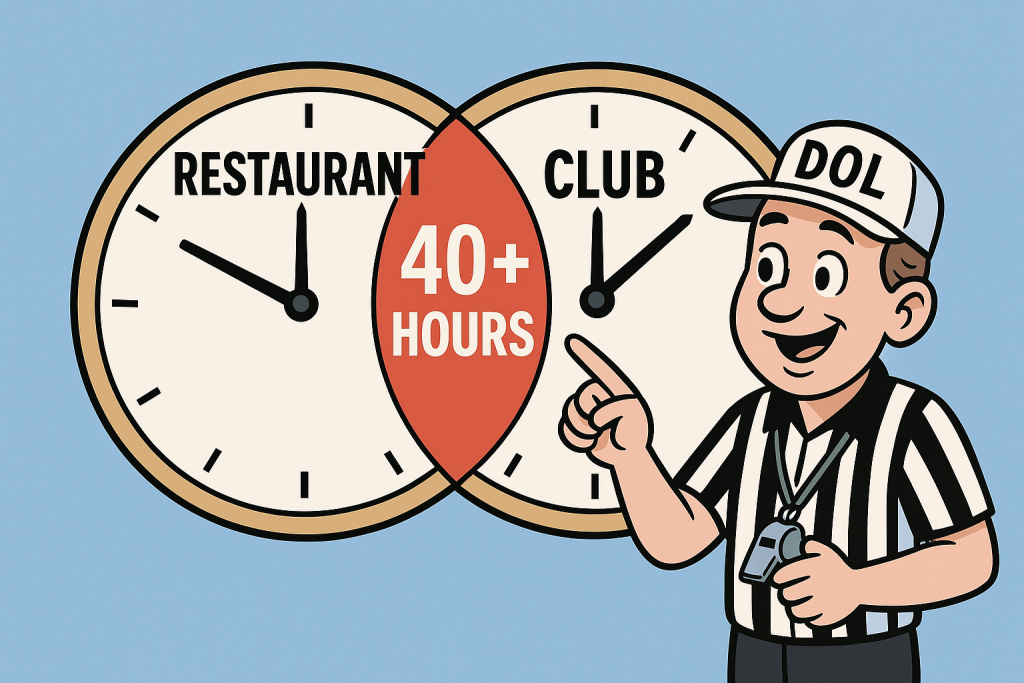

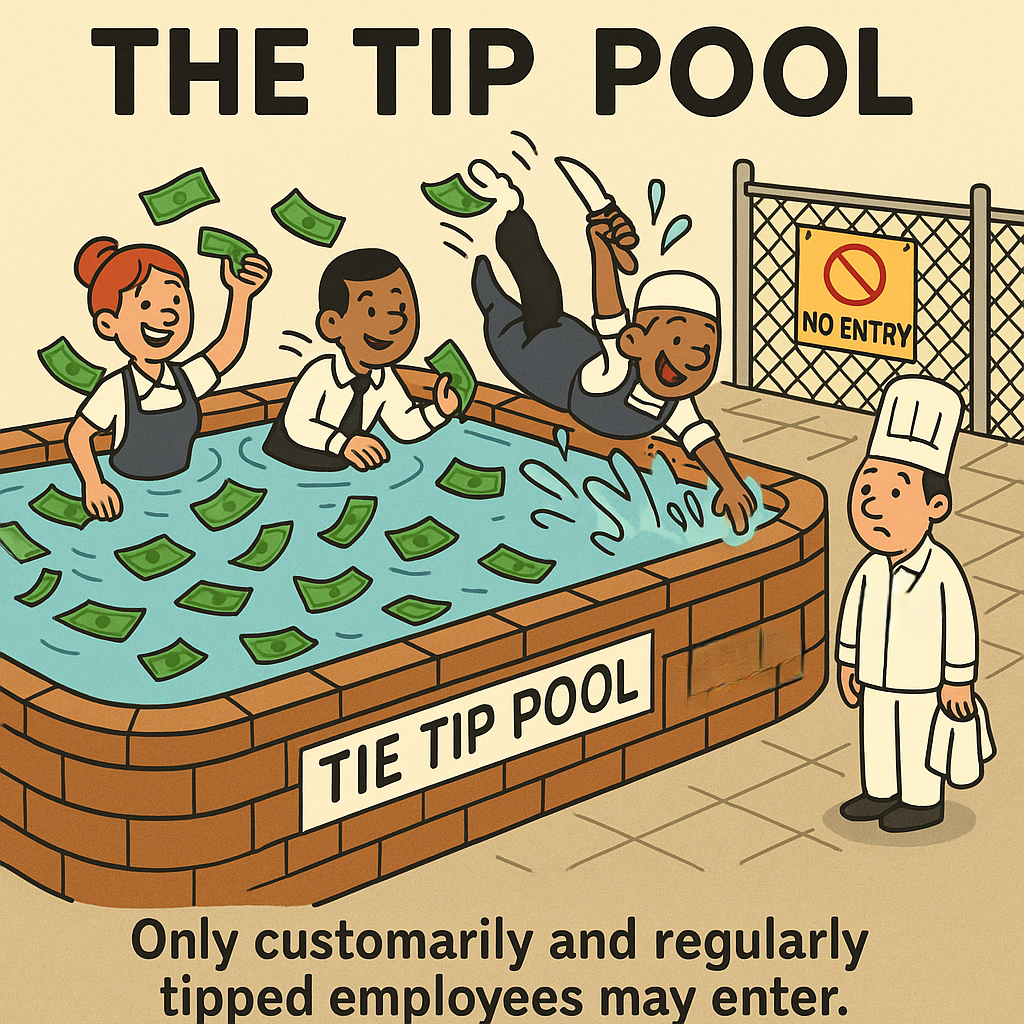

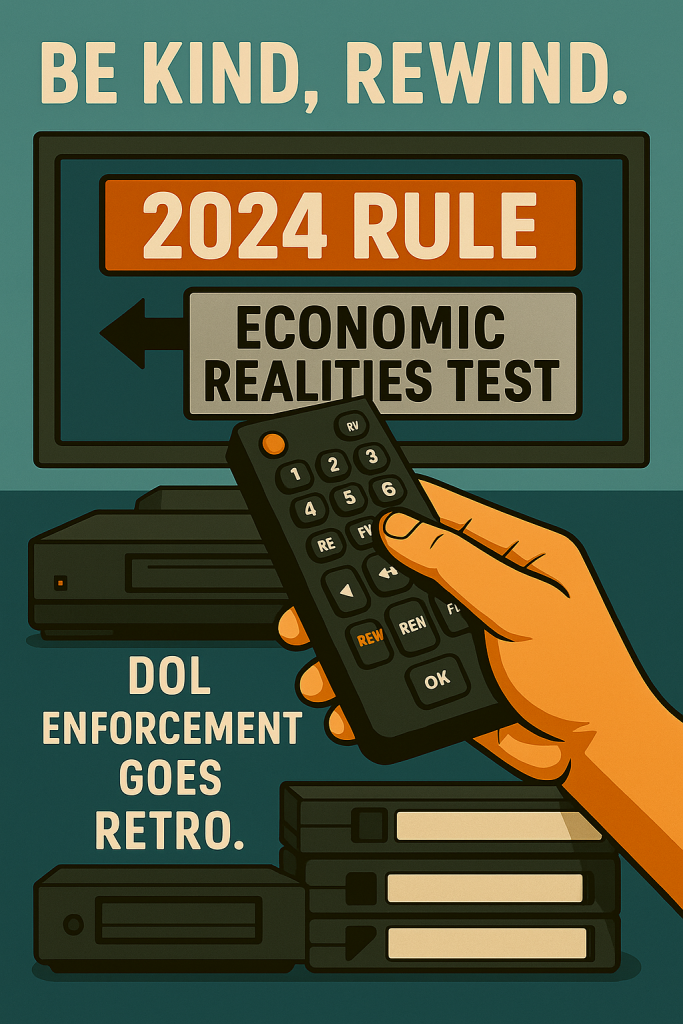

Ever wonder whether two connected businesses, like a restaurant and private club sharing a kitchen and managers, can dodge overtime by claiming they’re separate companies? The U.S. Department of Labor just answered that question loud and clear. Continue reading

The Employer Handbook Blog

The Employer Handbook Blog