Search

🦪 Shuck Yeah! The DOL Says Some Oyster Shuckers Can Join the Tip Pool

If you’ve been clam-oring for clarity on whether front-of-house oyster shuckers can share in the tip pool, the U.S. Department of Labor just served up a pearl of wisdom.

TL;DR: The Wage and Hour Division (WHD) issued a new opinion letter (FLSA2025-03) confirming that front-of-house oyster shuckers who interact with customers and enhance the dining experience may participate in a traditional tip pool when the employer takes a tip credit under the Fair Labor Standards Act (FLSA). But back-of-house shuckers working in the kitchen, with no customer contact, are still out of the pool.

🔗 Read the full opinion letter here

The Setup: Shucking and Sharing

A seafood restaurant wanted to know whether its front-of-house oyster shuckers, stationed behind the bar and visible to customers, could legally be part of a tip pool with servers for whom the employer takes a tip credit under the FLSA.

These shuckers didn’t take orders or handle sales directly — servers and bartenders did that — but they interacted with customers, discussed oyster varieties, made suggestions, and performed their craft in full view of diners.

Meanwhile, the restaurant also employed kitchen-based shuckers who prepared oysters behind the scenes, with no direct customer interaction.

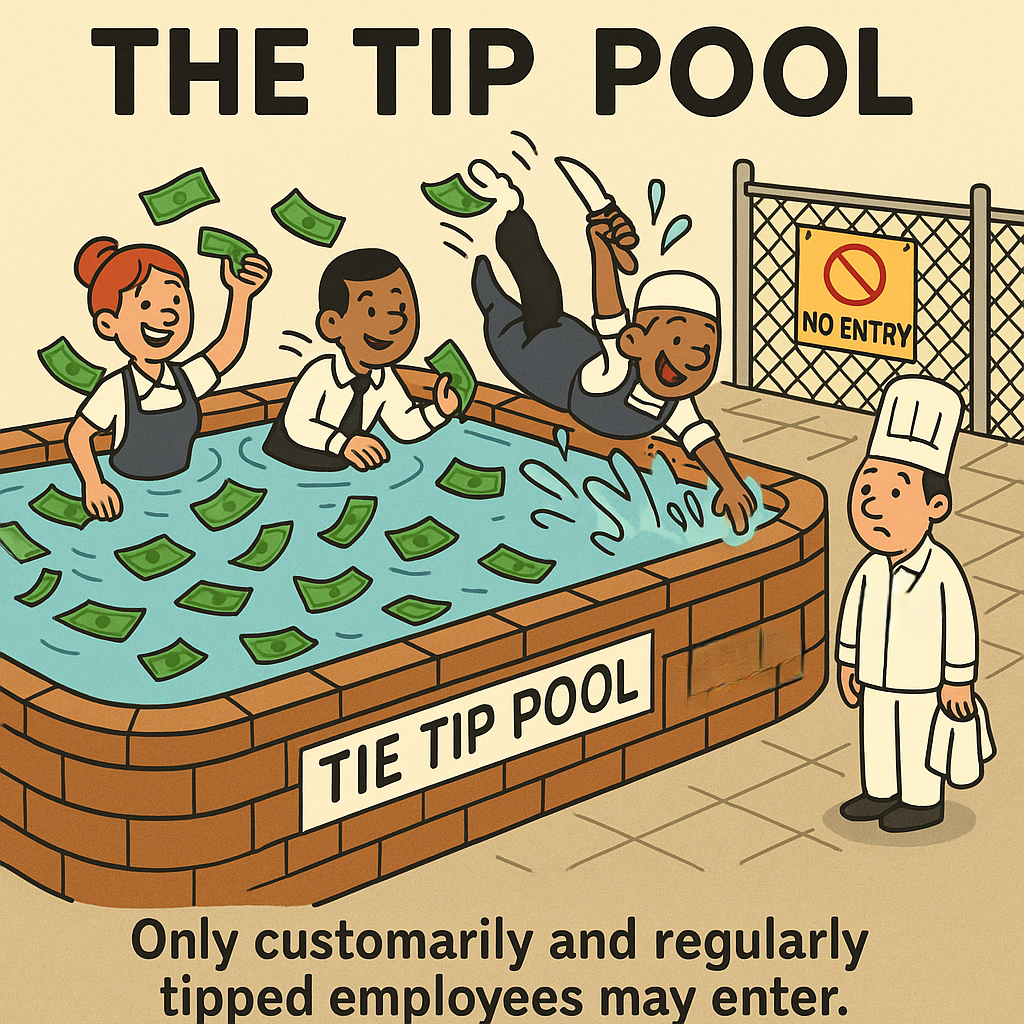

The Law: Who Gets to Swim in the Tip Pool

Under 29 U.S.C. § 203(m)(2)(A), an employer taking a tip credit can only require employees who customarily and regularly receive tips to participate in a tip pool. That includes traditional front-of-house roles like servers, bartenders, and bussers, but not chefs or dishwashers who don’t engage with customers.

The WHD has long recognized that customer-facing specialists such as sushi chefs, teppanyaki cooks, and sommeliers qualify as “tipped employees” because they add value through direct guest interaction.

The Ruling: These Shuckers Make the Cut

The WHD concluded that front-of-house oyster shuckers meet the test. Like sommeliers or sushi chefs, they:

-

Interact directly with customers,

-

Provide product knowledge and recommendations, and

-

Perform visible, service-oriented work that contributes to the guest experience.

Therefore, they may be included in a traditional tip pool with servers paid via a tip credit.

By contrast, back-of-house shuckers who work entirely out of sight and lack meaningful customer contact do not customarily and regularly receive tips. Thus, they must stay out of the pool.

Employer Takeaways

🧂 Tip pools must stay “shell-ected.” Only include employees who customarily and regularly receive tips through customer interaction and service duties.

🧾 Keep records clean. Employers must inform tipped employees of the tip credit and maintain accurate wage records to show compliance.

🚫 No mixing with managers or back-of-house. Even voluntary sharing with supervisors or kitchen staff is off limits if you’re taking a tip credit.

⚖️ Audit now, avoid trouble later. The DOL closely monitors tip pooling. One wrong inclusion and your tip credit could get tossed back.

The Bottom Line

Front-of-house oyster shuckers? You’re in the tip pool.

Kitchen shuckers? Sorry, you’re still out at sea.

When it comes to tip pooling, make sure your team is on the right side of the bar, or you could end up all wet with the DOL.

The Employer Handbook Blog

The Employer Handbook Blog