Search

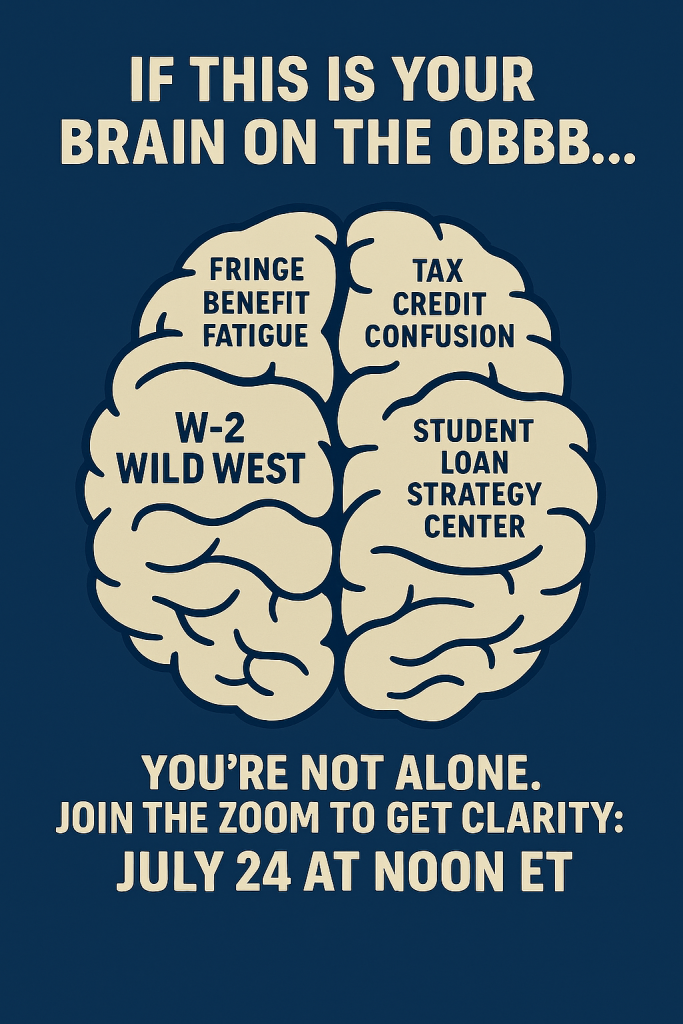

LIVE ZOOM PANEL: How the One Big Beautiful Bill Will Impact Your Workforce (July 24 at Noon ET)

Where have I been? I took a short break from July 4 through July 14 to spend some time offline on vacation with my family. Thanks for your patience—and I promise this one was worth the wait.

The One Big Beautiful Bill (OBBB) became law on July 4—and with it, major new tax and reporting obligations for employers. From payroll compliance to fringe benefit design, much of what’s in this law affects HR, legal, and finance teams directly.

To help employers get ahead of the coming changes, we’re hosting a live Zoom panel discussion (with time for audience Q&A) featuring three top minds in tax and benefits law.

🗓️ Thursday, July 24, 2025 at Noon ET

📍 Zoom: Register here

New rules, new risks—and new planning opportunities.

The OBBB introduces:

- Expanded W‑2 reporting (for tips, overtime, and more)

- New tax-favored savings vehicles called “Trump Accounts”

- Changes to fringe benefits, dependent care, student loans, and paid leave

- Tightened ACA compliance and new pre-verification requirements

I’ll moderate a 60-minute Zoom panel featuring three of my fabulous Pierson Ferdinand partners:

- Liz Delnegro, a corporate and tax partner with deep experience in regulatory compliance, M&A, and entity structuring. Liz frequently advises clients on federal and state tax credits and helps companies across industries develop practical, sustainable strategies.

- Greg McKenzie, a seasoned international tax advisor who helps businesses and investors navigate U.S. and cross-border structuring, M&A transactions, and IRS matters.

- Jewell Lim Esposito, a nationally recognized employee benefits lawyer with three decades of experience advising employers on ERISA, executive compensation, and strategic plan design.

Together, they’ll break down:

- What needs to be tracked in 2025 for reporting in 2026

- How new benefits structures will work—and how to align them with your existing offerings

- What’s optional, what’s mandatory, and where employers have flexibility

- Practical steps employers can take now to prepare for implementation

Even though many provisions don’t take effect until 2026, most of the operational heavy lifting starts much sooner. Payroll systems, benefit designs, nondiscrimination testing, and documentation all need attention now.

📍 Register here

🧾 All registrants will receive Liz & Greg’s whitepaper

The Employer Handbook Blog

The Employer Handbook Blog