Search

The Senate unanimously passed that House PPP reform measure

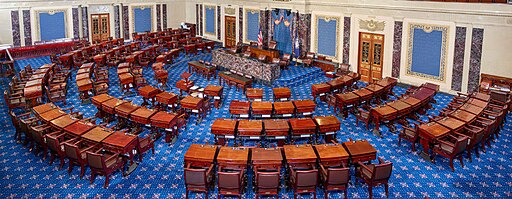

United States Senate / Public domain

I planned to follow up yesterday’s George Floyd post with a rundown of some of the many social media employment casualties featuring workers whose racism was really showing this past week on platforms like Facebook, Twitter, and Instagram. Folks, my Google Alerts were pumping out some real doozies!

But that can wait.

I’ve got good news. Good PPP news.

Remember last week when I blogged here about the Paycheck Protection Program Flexibility Act of 2020? Here’s some music to refresh your recollection.

(Close enough.)

(Sadly, that song is older than some of the people reading this blog post. Where’s my cane? Get off my lawn!)

Anyway, the Paycheck Protection Program Flexibility Act of 2020 cleared the House last week by a vote of 417-1. Among other things, here’s what this new bill accomplishes:

- It extends the forgiveness period to 24 weeks

- It replaces the 75/25 rule with a 60/40 rule

- All new PPP loans will receive a 5-yr maturity. Existing loans will remain at a 2-year maturity.

- It allows businesses that receive forgiveness to also receive payroll tax deferment

- It ensures small businesses won’t be penalized by high unemployment benefits

- It creates a safe harbor for businesses that are required to open at only 50 percent capacity

Last night, the question for the Senate was, “You down with PPP (Flexibility Act of 2020)?”

They answered with a unanimous, “Yeah, you know me.”

So, now the bill heads to President Trump for him to sign. Or not.

According to the Wall Street Journal (here), the White House declined to comment on the legislation. A spokesman for the Small Business Administration, which manages the program, didn’t respond to a request for comment either. But with only one dissenting vote between both bodies of Congress, I suspect that this gets signed ASAP.

If your business has an existing PPP loan, I suggest reaching out to your outside counsel for advice about loan forgiveness and the use of loan proceeds.

The Employer Handbook Blog

The Employer Handbook Blog