Search

COVID-19 paid leave was soooooo 2020 — unless you operate in Philadelphia.

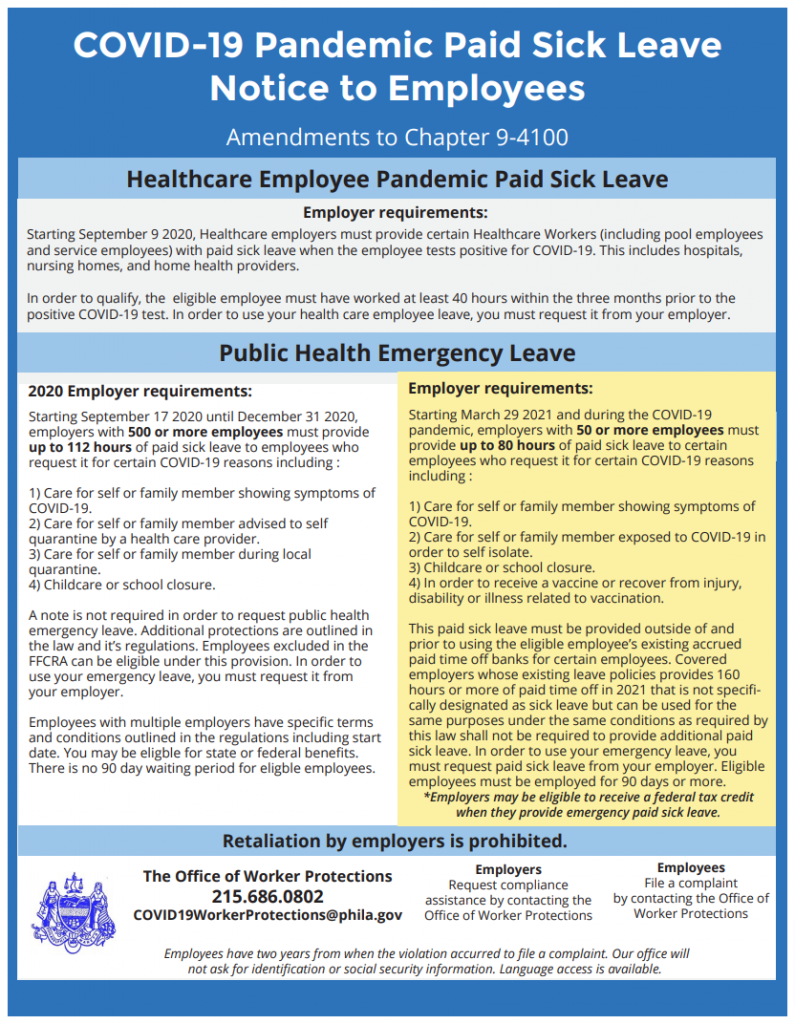

Pandemic Paid Sick Leave Notice to Employees Poster English

It’s the city of cheesesteaks, brotherly love, and, as of March 29, 2021, paid leave for companies with 50 or more employees.

Those businesses must provide up to 80 hours of paid sick leave to certain employees for specific COVID-19 reasons, including:

- Care for self or family member showing symptoms of COVID-19.

- Care for self or family member exposed to COVID-19 to self isolate.

- Childcare or school closure.

- To receive a vaccine or recover from injury, disability, or illness related to vaccination.

Only employees (whether full-time or part-time) that have been with the company for at least 90 days are eligible. Additionally, employees need to (i) work in Philadelphia, (ii) normally work for an employer within Philadelphia but currently telework from any other location as a result of COVID-19, or (iii) work for an employer from multiple locations or from mobile locations provided that more than have the time working is in Philadelphia.

This law does not cover seasonal or temp employees, state or federal employees, and independent contractors (1099 employees). However, unlike the FFCRA, which only applied to businesses with fewer than 500 employees, this new local law covers the big employers too. That said, if your business already offers 160 hours or more of paid time off in 2021, which can be used for any of the bulleted purposes identified above, you’re good to go and do not need to provide additional paid sick leave.

Employers must provide this COVID-19 leave before an eligible employee uses other forms of accrued PTO. If any employee requests and takes leave, the company may request that an employee submit “a self-certified statement” to document the leave. That’s it. However, nothing in the new law is meant to interfere with an employer’s right to request documentation connected with FMLA leave or an ADA accommodation.

Unlike the FFCRA, there is no tax credit available for the Philly leave. So, if your company has more than 50 employees but less than 500 and you are not providing FFCRA leave voluntarily, you may want to rethink that decision. Seems like a no-brainer to run the two forms of leave concurrently and get the tax credit.

Speaking of no-brainers, join me on Friday, April 9, at Noon ET. That’s when The Employer Handbook Zoom Office Hour — just one hour this week — returns. Joining me will be Meyling “Mey” Ly Ortiz. Mey is Managing Counsel of Employment & Labor at Toyota Motor North America. She and I will be addressing the rise in discrimination against the Asian American and Pacific Islander community. We’re also going to address the power of the mentor/mentee relationship during this pandemic. If those topics pique your interest, you can register for the Zoom by clicking here.

The Employer Handbook Blog

The Employer Handbook Blog